Dear Clients and Friends,

As we enter the post Labor Day selling season we hope our summary below is helpful in keeping you up-to-date on the New York City residential market…

Market Snapshot:

- New York City is experiencing strong demand relative to supply, however it’s a two-part tale…

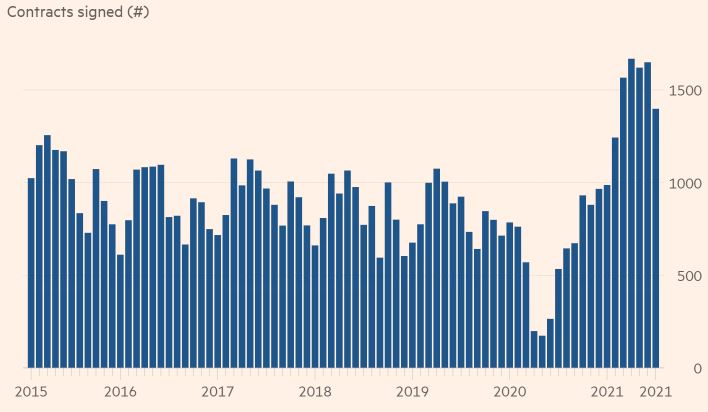

- The current Market Pulse (contracts signed as a percentage of new listings) is exceeding 2015 levels (the height of the NYC residential market), while achievable pricing is more in line with early 2019.

- Contracts signed relative to new inventory peaked in July and subsequently dropped in August (which is typical around Labor Day). Manhattan reported 723 new listings for the first full week of September – a 30% increase above the period’s five-year average. To add further nuance:

- If one subtracts the number of contracts signed and properties taken off the market in September, new inventory is still at a net deficit.

- For properties above $5 million post Labor Day inventory remains consistent with prior years.

- There were ~ 4,997 sales reported in the second quarter of 2021, the highest since 2010.

- It is important to note that demand and buyer activation to transact remain driven by an expectation of fair market pricing and value. Properties with aspirational asking prices are either not going under contract or subject to significant haircuts to their ultimate selling price.

- In our experience, average negotiability on new development sales for well-located projects with good sales traction (~40%+ sold) has been 2-5%, inclusive of closing cost concessions.

- Of course, there are exceptions. Some projects in coveted neighborhoods with little open land to develop are not negotiating at all. The Benson on Madison Avenue between 79th – 80th Streets, for example, is now fully sold out and actually raised its initial pricing schedule. Meanwhile other new development sponsors which face more competing projects in their immediate vicinity and never marked their prices to 2020/2021 buyer expectations are negotiating net discounts in excess of 10%.

Strongest Performers

- Within the luxury segment we are seeing buyers drawn to homes which offer them privacy, generous floor plans with home offices and room for occupants to spread out, and outdoor space. Accordingly, apartments with terraces and townhouses have garnered particularly strong interest.

- Through the first five months of 2021, 226 penthouse contracts were signed in Manhattan, the most since the figure began being tracked in 2007.

- As of September 12th, 2021, 154 contracts had been signed YTD on Manhattan townhouses over $4 million – the highest number achieved since 2014’s 153 contracts (and we are not even through the year).

- The average price/SF for a townhouse was ~$1,825/SF and the average size was ~5,647/sq. ft.

Further Factors to Consider

- There is a growing consensus that employees will need to be imminently vaccinated in order to return to work – which has been further underscored by President Biden’s announcement that professionals at companies with 100 or more employees must be vaccinated or submit to mandatory weekly testing. Ultimately, we view this as positive for the New York residential market’s ability to retain talent and the expectation that individuals will spend a growing portion of their time safely in the office.

- According to current data estimates collected by the Partnership for New York City, approximately 40% of professionals are expected to return to the office by September 30th, with that number growing to 76% by the New Year.

- An additional bolster for families to move to or stay in NYC has been the full reopening of NYC public schools this month for in-person learning along with many of the city’s preeminent private schools.

- Broadway Shows (a cornerstone driver of NYC’s singular appeal to residents and tourists) have for the most part re-opened as of September.

2021 Novack Team Transaction Update:

$50 MILLION CLOSED OR UNDER CONTRACT JANUARY – SEPTEMBER 2021

$50 MILLION CLOSED OR UNDER CONTRACT JANUARY – SEPTEMBER 2021