Dear Clients and Friends,

As we move into 2021 we thought it would be helpful to provide an overview of the current NYC residential market based on both our personal experience and market data…

We are seeing a relatively strong recovery in sales activity post-lockdown, and a definitive buyers’ market with supply/demand reaching more balance as we approach Spring/Summer and broader distribution of the vaccine. The rental market (which is driven by the immediate appeal and availability of NYC’s amenities vs. a longer-term investment outlook) has been extremely soft, probably down ~10-15% from 2019.

- As a jumping off point, it’s important to remember that prior to the pandemic prices had already decreased by approximately ~25% from high of late 2015 to January 2020.

- The site unseen sales which occurred when brokers were prohibited from in-person showings during lockdown (~April – June 2020) were primarily either pre-existing contracts, or a small self-selecting group of need-to-sell owners and unemotional investors – thus not really reflective of the broader buyer and seller pool. In addition, the number of new listings that posted over this period was only ~20% of a typical Spring market. These trades generally represented the largest COVID discounts.

- Since in-person showings resumed in late June 2020, buyers have required a strong value proposition and typically need to ‘love’ a property in order to transact. Many have tended to wait on the sidelines until they fear losing a home to another purchaser, at which point they’ve become ready to negotiate in earnest.

- Over the past few months we’ve seen a noticeable increase in purchaser activation, and an uptick in contracts signed as a percentage of new listings. This haslargely been driven by vaccine approvals and a corresponding perception by buyers of a finite window to get the ‘best deal’, along with sellers being more flexible. While contract activity is up, we don’t anticipate an increase in prices in the near-term.

- The number of recorded signed contracts for 4Q20 has already exceeded 4Q19 (though this trend was partially bolstered by pent up-inventory from a largely missed Spring market).

- The greatest portion of activity has been in the <$3 million category, however we are seeing the number of contracts signed for properties at higher price-points continue to grow spurred by opportunistic pricing, a desire to upsize, and some return to NYC from second homes.

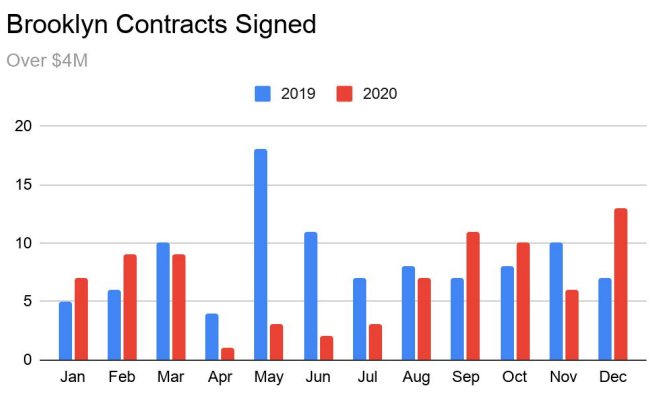

- Per recent data, there were 232 contracts signed in 4Q20 at $4 million and above, compared to 219 for 4Q19

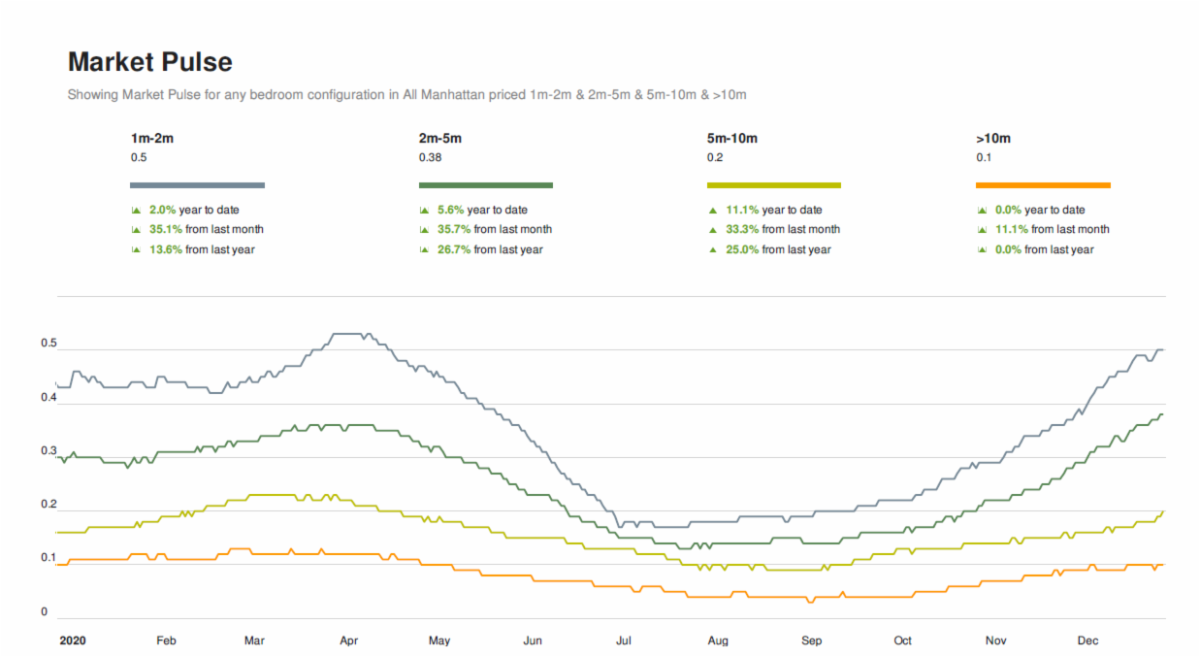

- The ‘Market Pulse’ chart below reflects the continued recovery as we move towards greater equilibrium in the sale market. ‘Market Pulse’ represents contracts signed for a given month as a percentage of new listings. The higher this percentage, the more supply/demand favors sellers and visa-versa.

- Based on our experience properties are going under contract between 4 – 7% below their last asking price, though discounts can be far steeper at the highest price points.

- While each situation is unique, much of the current buyer base is motivated by a desire to ‘trade-up’.

- At present, purchasers can achieve a superior level of quality and size for a given price-point than they have been able to for the past several years, and also have a greater appreciation for these attributes given their time spent at home during the pandemic.

- Accordingly, the average size of condos purchased over the last 14 weeks through late December was ~5.5% larger than a year ago.

- Private outdoor space is also highly valued – a trend which we anticipate to have long-term appeal.

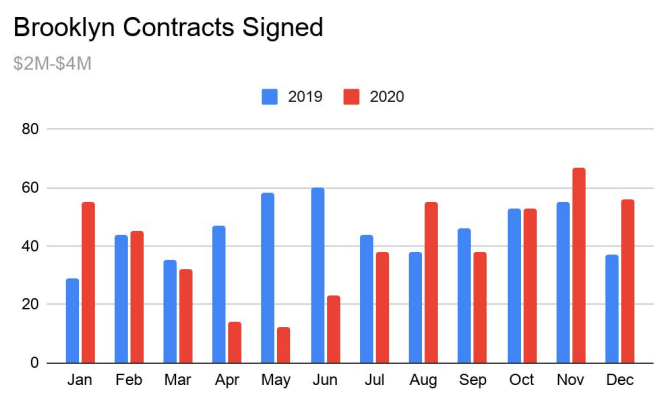

- Prime Brooklyn (DUMBO, Park Slope, Brooklyn Heights, Boerum Hill, Cobble Hill, Carroll Gardens, etc.) has seen particularly robust activity taking into account the pandemic. Similar to Manhattan, townhouses and properties with private outdoor space have seen the greatest demand.

- Looking forward, NYC still has much work to do in order to make up for lost city revenue during the pandemic, and ensure the continued general appeal and quality of the city’s services and infrastructure. For the time being, sizable 2020 Wall Street bonuses will provide some measure of tax revenue. In addition, the potential for less uncertainty now that the general election has been confirmed, increased federal aid, and a new mayor with stronger financial and budgetary expertise provide some hope.

Please don’t hesitate to reach out to us with any questions, or on any of your real estate needs.

Warm Regards,

Alex and Sybille